30% Drop in Crypto Trading Volume and NFT Sales in April

In April, the crypto and the non-fungible token (NFT) market witnessed significant declines, signaling a cooling period for digital asset transactions.

As trading activities dwindled, key players and Crypto platforms faced marked declines in transaction metrics. This shift indicates a recalibration of crypto market dynamics, reflecting investor caution and a reevaluation of asset values.

Crypto Trading Volume and NFT Sales Drop

Data from centralized exchanges (CEXs) revealed a substantial decrease in spot trading volumes. These have plummeted by 35.7% from March’s $2.49 trillion to just $1.6 trillion.

Binance, the largest player in the field, accounted for 43.7% of this volume, translating to approximately $699.25 billion.

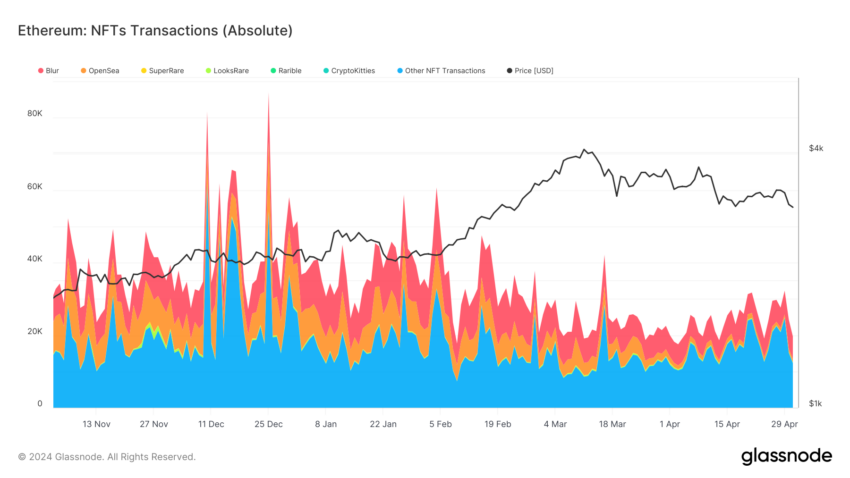

Parallel to this, the NFT sector also experienced a downturn. NFT sales dipped to $1.15 billion in April, marking a 31.26% decline from the previous month.

The drop was not limited to sales alone. Indeed, the number of active NFT buyers and sellers also decreased substantially. Buyer participation fell by over half, down 51.88%, and seller activity reduced by 45.72%, indicating a shrinking market interest.

The downturn affected several blockchains where NFTs are commonly traded. Ethereum and Solana, for instance, saw their NFT sales decrease dramatically.

Ethereum’s NFT transactions halved, sinking by 56.8%, while Solana recorded a 39.4% fall in sales. This trend was consistent across various blockchains. However, only a few exceptions, like Immutable X and Avalanche, surprisingly registered increases in NFT transactions.

Read more: 7 Best NFT Marketplaces You Should Know in 2024

Specific Bitcoin-based NFT collections bucked the downward spiral despite the overall negative trend. In April, The Bitcoin Puppets and the Bitcoin-based WZRDs collection saw their values skyrocket by 2,064.97% and 25,796%, respectively.

“Given that NFT loan originations are still dominated by Ethereum NFT collections due to the synergy between Blend and Blur, the impact of increasingly popular Bitcoin Ordinals on the NFT lending market may be worth watching,” researchers at CoinGecko wrote.

This suggests that while the broader market is in decline, niche collections can still capture significant interest and command high valuations.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.